Please, please share asap.Hope to see you Jan 16, info follows.

Date: January 8, 2023 at 2:03:28 PM EST

To: triciastall@gmail.com

Subject: Stop Senate Bill 930 Euthanasia

Reply-To: "Sheila M Furey, MD from Sheila's Newsletter"Stop Senate Bill 930 Euthanasia

Open in app or online Good Day Friends,

Thank you for helping us reach our goal of 100 people on our Rumble channel. Let's kick it out of the ballpark to reach 200.

Today, we need to stop Senate Bill 930. This bill grants the "healthcare" cartel the authority to kill you. This is not about death with "dignity" or support in dying or whatever catch phrase they want to spin. It is plainly and simply about manipulating, coercing, forcing a person to die via a pill or injection.

Sen. Ghazala Hashmi (804-698-7510) has introduced Senate Bill 930-Medical Aid in Dying. You can change the words but it all comes down to murder. This bill is not about aid and comfort in dying. This bill is about the medical cartel conspiring to kill you and your family members.

Please click on the above bill to read. Then call her office 804-698-7510 every day until she pulls this bill. Share this with every friend, church member and every member in our Veterans groups. Further, we need to ensure that Sen. Hashmi never holds public office again.

How many of you had loves ones in the hospital dying of Covid and you fought day and night to save their lives? How many of you fought hospital administration and doctors that wanted to place your loved ones on a DO NOT RESUSCITATE (DNR) order? I have taken your phone calls and walked with you as your fought and prayed. Your loved ones are alive because you fought the biggest cartel in the world. You fought against the genocidal system that saw your loved one as simply "too old, too frail, too sick" to receive or continue treatment. Sadly, many lost loved-ones because our corrupt medical system chose not to offer safe effective low-cost life saving medications, but expensive (hospital bonus) dangerous medications that led to kidney failure and death.

We can look at this from all kinds of moral perspectives, which there are countless and God is watching us. For today, let us simply look at this as a FREEDOM issue. You have a right to life and the government should not interfere with your right to life. The government should not have any role in hastening the end of your life. We are not to be reduced to productive vs. unproductive citizens.

The medical-government-military cartel controls the hospitals, your doctors-paid employees, the pharmacies and they want to control you. This evaluation is completed by a member of the healthcare cartel that views you as a burden. You have a terminal illness. Who determines terminal? Many people have terminal illnesses and live many years. Who determines your competence to make this decision? A social worker? Who determines quality or quantity of life? The doctors with the needle? The doctors with the pill? The doctor who gets a bonus for providing "quality" healthcare? The over-burden staff who just want a day off?

As always, follow the money. The advocates for Dying with Dignity and other organization are the happy recipients of grants (your tax dollars) and donations that are used to pay their salaries rather than provide care and treatment. Link

This is not a slippery slope. This is downhill slide on black ice. We need only to look to our neighbor to the north. In Canada, you can be euthanized for Covid-19 (even though safe, low-cost treatment is available), mental illness, poverty and being a disabled veteran. Yes, Canada wants to tell you that you have a civic duty to die. I am not making this up. The Canadian government has gone so far as to create a coloring book for children in order to normalize this process. Link Veterans in Canada refer to the Triple D: delay, deny and dead veterans. We are well aware of the lack of care that our veterans receive here in the United States. Are we any different that our neighbor to the north? LINK LINK

Please contact Sen. Hashmi 804-698-7510 and tell her to withdraw her bill. Tell her your story, every day.

Join the VAMFA as we continue to educate and advocate for you and your family.

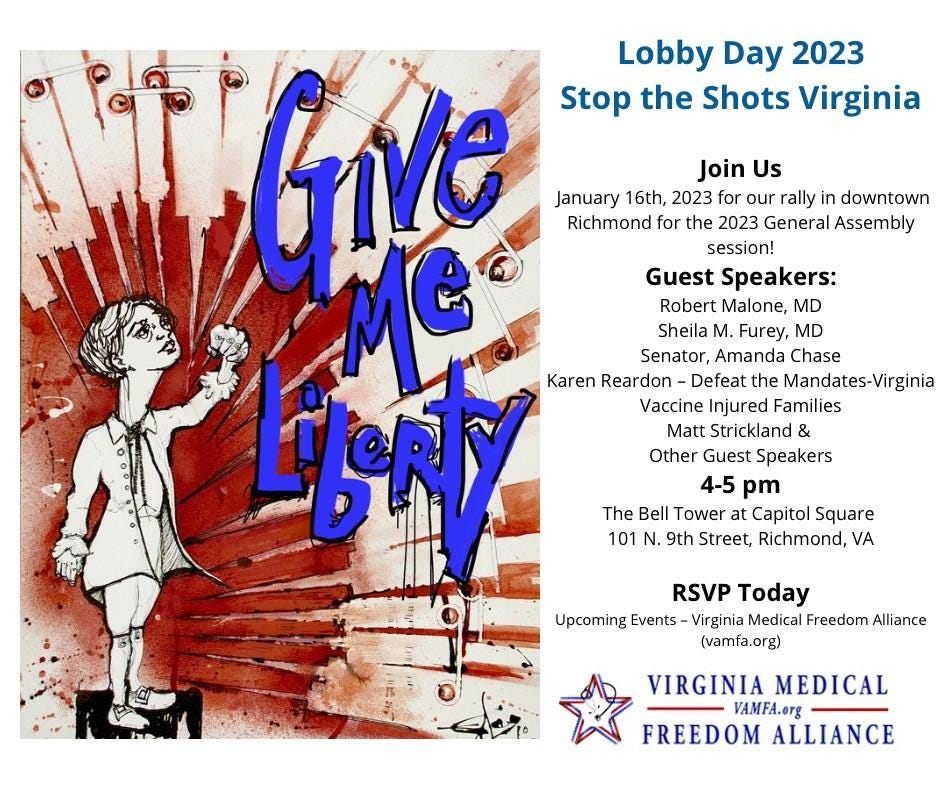

Please join us on January 16 to rally at the Capitol Bell Tower in Richmond to stop the deadly shot. Join our next Zoom call on January 10th at 8 pm.

God blessing to each of you,

Sheila M. Furey, MD