| Dear Friend- Just like, that we are at the end 2017. It's been a historic year for our country. There have been highs and lows along the way. However, I am confident the American spirit remains unshaken. Our shared values of life, liberty, and the pursuit of happiness draw us together far more than any division may drive us apart. As this year comes to a close, I've looked back on all that the last twelve months had in store. I've traveled all across our district, talked with thousands of constituents, worked to rebuild our nation's military, and helped provide tax relief for our working-class families and small businesses.

January

I toured Naval Surface Warfare Center Dahlgren with Chief of Naval Operations Admiral John Richardson. We discussed my legislation, passed in this years NDAA, that would make it the policy of the United States to achieve the Navy's requirement of 355 ships. Familiar faces in new places: Lawmakers to watch on defense in 2017, Military TimesFebruary

I kicked off my healthcare listening tour at Mary Washington Hospital in Fredericksburg. Throughout the year, I met with healthcare providers and community leaders to discuss what Congress can do to expand access to affordable healthcare. Rep. Rob Wittman, the latest in a line of influential chairmen, Defense NewsMarch

I met with the National Association of Elementary School Principals to learn about important issues facing schools, students, and administrators. We discussed our mutual support for measures in ESSA that eliminate the one-size fits all federal approach to education, schools, and teacher accountability measures.

As Co-Chair of the Congressional Chesapeake Bay Watershed Caucus, I spoke with the Choose Clean Water Coalition, the First District Environmental Council, and Chesapeake Bay Foundation on Chesapeake Bay Day. I shared all the work I've done to clean up the Bay, protect wetlands, and support water research. Rep. Wittman fears budget inaction would hurt shipyard, Daily Press

I held a press conference with Chief Stephen Adkins of the Chickahominy Tribe, Rep. Scott, Rep. Connolly, and Rep. Beyer. I sponsored H.R. 984, the Thomasina E. Jordan Indian Tribes of Virginia Federal Recognition Act of 2017, legislation that grants federal recognition to six Virginia Indian tribes. It passed the House and is awaiting consideration by the Senate. Caroline County commemorates anniversaries of WWI and WWII, The Free Lance Star

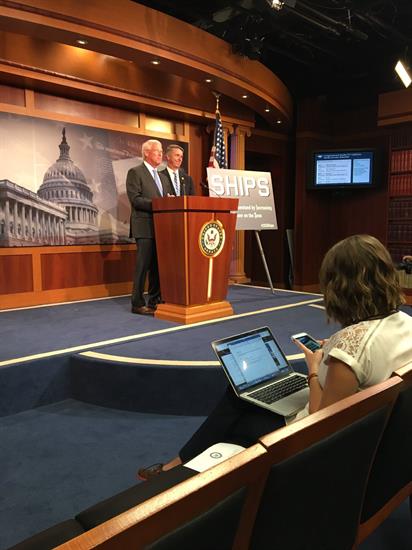

I, along with my colleague U.S. Senator Roger Wicker, R-Miss., introduced bicameral, bipartisan legislation that would make it the policy of the United States to achieve the Navy's requirement of 355 ships. Under the "Securing the Homeland by Increasing our Power on the Seas (SHIPS) Act," the fleet would be comprised of the optimal mix of platforms, with funding levels subject to annual appropriations. Currently, only 276 ships are in the battle fleet. This legislation passed under this year's National Defense Authorisation Act. Wittman comfortable on the water, devoted to the bay, Richmond-Times Dispatch

I attended the commissioning of the USS Gerald Ford (CVN 78).This carrier will house over 2,600 officers and crew. I spoke with the crew and shipbuilders about ways I, as the Chairman of the Seapower and Projection Forces Subcommittee, can work with them to help meet our nation's security goals. Wittman: Strong Navy is best guaranty, Daily Press August

I was honored to participate in a Veteran Pinning Ceremony to recognize the service of several Veterans at the Commonwealth Senior Living community in Farnham and to discuss my commitment to ensuring our veterans can access the benefits they've earned through their service to a grateful nation.

I joined Governor McAuliffe and Rep. Connolly to commemorate job creation in Virginia's First District by attending a ribbon cutting for Iron Mountain's new data center, the first and largest of its kind in Prince William County. In Congress, we have taken many steps to roll back federal regulations so business can do what they do best— create jobs. October

I hosted a Rural Broadband Task Force Summit at the Northern Neck Electric Cooperative in conjunction with FCC Chairman Ajit Pai. We had a great discussion about how we can provide broadband to all of Virginia's First District. U.S. is overdue for more inclusive history, The Virginian-Pilot

I hosted a "Faces of Tax Reform" event in Fredericksburg to talk with small business owners and House Republican Conference Chairwoman Cathy McMorris Rogers about the need to reform our nation's complex and outdated tax code. Tax reform isn't about brackets -- it's about people, House Republicans

I joined Speaker Ryan and other members of the House Armed Services Committee for the signing of the National Defense Authorization Act. President Trump signed the NDAA later in December; I am confident the NDAA will provide the U.S. Armed Forces with the resources to continue keeping our great nation safe. A congressional perspective on the Fitzgerald, McCain collisions, Defense News

It's an honor to serve you and Virginia's First District in the People's House. Have a happy new year! I'll see you in 2018.

| ||||||||||||

|

| ||||||||||||

| Offices | ||||||||||||

| ||||||||||||

|

| ||||||||||||

| *Please do not reply to this email, as that mailbox is unattended. To better serve the constituents of the First District I have established a contact form on my website. Please click here if you would like to send additional correspondence. |

Wednesday, December 27, 2017

12 Months. 12 Stories. 12 Photos.

Wednesday, December 20, 2017

A Real Christmas Surprise: Bring Healthcare Home in Virginia

Created with NationBuilder, software for leaders. |

Monday, December 11, 2017

Your #5Actions for This Week!

Dear Rob,

We're making a holiday action list and checking it twice! Gonna tell our decision makers who's naughty or nice. Moms are coming to town ... Please join us to take urgent action on a suite of red-hot priorities this week! And be sure to share with friends and family too. Together we're making this holiday season bright!

Without further ado, or bad puns from us, here are the 5 actions for this week! ->

1. Sign Up to Deliver a Tax Letter to Your Local Members of Congress' Office!

BACKGROUND: The GOP tax plan will raise our taxes, take away the health care of 13 million people, and lead to massive cuts in programs that boost our families all in order to give tax cuts to millionaires and wealthy corporations. Republican leadership is moving super, duper fast to pass a final bill by the end of this week---but they still need to reconcile the differences between the Senate and House bill (both evil and awful in their own right). This is an all-hands-on-deck moment! We need you to speak out! We need you to show up…literally!

Sign up now to print out a letter and bring it to your local member of Congress’ office! When you sign up, you’ll receive an email with all the information you need to make your delivery. We’ll send you a short 2-pager with a letter for you to sign and stories about the moms of America that will be hurt by the GOP tax plan. We'll also give you some talking points and a link of where to find your local Senators and Representative's office.

2. Tell FCC and Congress: Protect Net Neutrality!

BACKGROUND: An open internet is essential to protecting many of the freedoms we hold dear: Our ability to innovate, speak our mind, connect, and hear diverse voices and opinions. The Federal Communications Commission (FCC) wants to roll back 2015 rules that require internet service providers (ISPs) to treat all content the same. We can't let them. Net Neutrality ensures a level playing field. It stops ISPs from blocking or suppressing content. It limits them from manipulating the speed at which you receive certain content, or selling premium access to the highest bidder. Net Neutrality ensures that when we raise our voices online, they can be heard - loud and clear. Add your voice to the millions of people calling on the FCC and Congress to protect Net Neutrality.

3. Urge NO on National Concealed Carry Reciprocity!

BACKGROUND: Last week, the U.S. House voted on and passed national Concealed Carry Reciprocity Act of 2017, which compels states to recognize concealed carry permits from all over the country, regardless of how lax permitting standards are in other states. The fight to stop this dangerous legislation now moves to the Senate. Should federally mandated concealed carry become the law of the land, an individual state would no longer be able to control who is authorized to carry a concealed gun within its borders. Police would not be able to quickly find out if out-of-state permits are valid, putting law enforcement and the public at higher risk of harm. With Americans already about 20 times more likely to be killed by a gun than people in other developed countries, and the nation still grieving the recent Las Vegas and Sutherland Springs shootings, two of the worst incidents of gun violence in recent history, now is not the time to weaken common sense safety standards or states rights!

4. Be an #ACAdefender for Open Enrollment 2017!

BACKGROUND: It’s time to #KeepMarching and use our outside voices for health care! President Trump and his administration have taken some terrible steps this year to sabotage our health care, limit consumer access to information, and confuse the public about our options for coverage. We need to do everything we can to help get the word out that quality, affordable health care coverage options are available at HealthCare.gov thru December 15th!

5. Protect DREAMers

Stand with young adults who have been here since they were children by protecting the path to legal status for DREAMers! President Trump created a crisis in our country when he decided to rescind the Deferred Action for Childhood Arrivals (DACA) program. Through this decision, he snatched away the livelihood and aspirations of 800,000 young adults who have been here since they were children. **Join us in asking Congress to stand with 800,000 DREAMers and pass the DREAM Act!

Thank you for all you do! #KeepMarching!

- Karen, Kristin, Kristin, Gloria, Khadija, Xochitl, Donna, Nate, and the MomsRising Team

P.P.S. This whole Top #5Actions list is up on our blog too! Use this link to share with family and friends on Facebook, Twitter or anywhere else: https://action.momsrising.org/go/33991?t=12&akid=10070%2E847037%2E-zfIXj

Thursday, December 7, 2017

This tax plan:

|

This tax plan:

|

Monday, November 27, 2017

FWD: Quick signature: Tell the Senate to reject Trumpcare in the Tax Bill!

Rob -

I wanted to make sure you saw the important email below. The U.S. Senate is voting THIS WEEK on a terrible tax bill that will hurt working families and decimate our health care by sabotaging the Affordable Care Act and cutting Medicaid and Medicare.

*Can you sign our letter to U.S. Senators to reject any tax plan that benefits the wealthy and mega-corporations over working families, health care, and our economy? When you click you’ll automatically sign on if we already have your information.

MomsRising is delivering this letter on Wednesday and we need your signatures to help stop the bill. The more signatures, the bigger our impact. Time is short. (After you sign on, please also call your U.S. Senators to make your voice loud and clear that the American people don’t want the terrible, no good, very bad U.S. Senate Republican's tax bill. We’ve made it easy! Just dial 1-844-633-2048 and we’ll connect you.)

Not only is this bill a bad deal for families and our health, it’s also terrible for our nation’s economy! Economic experts across the country agree that the bill would greatly increase the deficit and analysis by the Penn-Wharton School (President Trump’s own alma mater!) found that the U.S. Senate bill would increase the national debt $1.4 trillion to $1.6 trillion. [1] Our children will be paying for this bill for decades to come just so the mega-rich and Wall Street can line their pockets.

*Sign on now to protect our health care and speak out against the U.S. Senate Republican’s tax bill! When you click you’ll automatically sign on if we already have your information.

Together we are a powerful voice for the health of families.

- Felicia, Elyssa, Donna, Kristin, and the entire MomsRising.org/MamásConPoder team

P.S. Don’t forget to call your U.S. Senators, too! The vote is happening soon, so we need every call possible to be made. Dial our hotline and we’ll connect you: 1-844-633-2048

[1] The Washington Post,

37 of 38 economists said the GOP tax plans would grow the debt. The 38th misread the question.

---------Forwarded message---------

|

Dear Rob,

I’d say it’s unbelievable, but at this point Congress really is starting to feel like a season of Stranger Things. Like the monstrous ‘Demogorgon’ that keeps coming back after it’s been sent to the ‘upside down’ (and you hope is gone forever)… the devastatingly bad Trumpcare just keeps coming back!

And this time it’s come in the form of the terrible, no good, very bad U.S. Senate Republican tax bill.

Quick Signature: Tell Republicans in Congress to stop attacking our families’ health care, reject their tax plan that benefits the 1% and wealthy corporations over working families, and end partisan attempts to dismantle the Affordable Care Act! *When you click you'll instantly sign if we have all the required information.

This week, U.S. Senate Majority Leader Mitch McConnell announced that the Senate tax bill would include a provision to do away with the Affordable Care Act’s individual mandate, which is a cornerstone of the law. Without it, the whole system becomes off balance, tilting the market toward older, sicker consumers, driving up costs, decreasing the number of insurers who participate in the marketplace, and undermining the entire healthcare platform. The Congressional Budget Office recently estimated this would leave 13 million Americans without health insurance and raise premiums in the individual marketplace by 10 percent in most years over the next decade. [1]

Do you see what they are doing here? They are turning an already awful tax bill—that benefits the wealthy and powerful over working families—into a truly cruel anti-health care bill that strips millions of Americans of the health care coverage they need to survive and thrive.

Yesterday, the House of Representatives passed their tax bill and now the Senate is moving quickly to vote on their plan after Thanksgiving. Both plans increase the deficit, heavily benefit the wealthy and mega-corporations, and would lead to deep cuts to Medicaid, Medicare, and other programs that boost families in the future, primarily hurting the elderly and working families. [2] This is outrageous! We need to tell Congressional Republicans to send their tax bill, Trumpcare, and the idea of cutting our health care (Medicaid, Medicare, and the Affordable Care Act) to the ‘upside down’ forever.

Sign now! Tell Republicans in Congress to reject Trumpcare and end partisan attempts to repeal our health care without a replacement! *When you click you'll instantly sign if we have all the required information.

The proposed tax plan is already disastrous—in order to pay for the tax cuts that President Trump and extremist Republicans in Congress want for their rich cronies and Wall Street corporations, they need to make massive budget cuts in other places, mainly by making cuts to health care. It would also raise taxes on 1 in 3 middle class families—all to give massive tax cuts to millionaires, billionaires, and giant corporations. Clearly their special interests are more important than the health and well-being of working America. When you click the link above, you’ll automatically sign onto our letter to Congress that reads:

I am a U.S. taxpayer and voter, and I’m writing to ask you to stop attacking our families’ health care, end partisan attempts to dismantle the Affordable Care Act (ACA), stop cuts to Medicaid and Medicare, and reject any tax plan that benefits the wealthy and mega-corporations over working families and our economy!

Making cuts to programs that families rely on to stay healthy like Medicaid, Medicare, and the ACA in order to give huge tax breaks to millionaires and wealthy corporations is unconscionable. Our tax policies should reflect the values of our country, and placing more value on the already wealthy and corporations over the health of our families goes against America’s moral compass and is destructive to our economy as a whole.

We need real tax policies that make sure the wealthy and big corporations pay their fair share and that working families can benefit equally from our tax system and economy. Please stop working to sabotage the ACA and cutting Medicaid and Medicare and get to work on shoring up programs that benefit low- and middle-income families as well as boost our economy!

Take action now! Tell Congress our tax policies should make sure the wealthy and big corporations pay their fair share and that working families can benefit equally from our tax system and economy. *When you click you'll instantly sign if we have all the required information.

Congressional Republicans are obsessed with attacking our health care and bringing the Demogorgon—err... Trumpcare—back from the ‘upside down’ and this time they’ve snuck it into their tax bill. We cannot let this happen—Congress must reject this tax package!

The more who speak out, the better! Please take a moment to forward this email to your friends and family, and post our action link on Facebook and Twitter: http://action.momsrising.org/sign/trumpcare_tax/?t=11&akid=9991%2E847037%2EerWTwY

Together we are a powerful voice for the health of families.

- Felicia, Elyssa, Donna, Kristin, and the entire MomsRising.org/MamásConPoder team

P.S. Have you watched our tax explainer video yet? It’s super awesome! Erica Williams breaks down everything you need to know about the awful tax proposals. Watch it now!

P.P.S. It is open enrollment season at HealthCare.gov until December 15th! Help spread the word by becoming an #ACAdefender!

[1] Congressional Budget Office, Repealing the Individual Health Insurance Mandate:

An Updated Estimate

[2] Center on Budget and Policy Priorities, Senate Tax Bill Has Same Basic Flaws as House Bill

Sunday, November 19, 2017

Your #5Actions for This Week!

|

Dear Rob,

Republicans in the U.S. Congress are quickly trying to pass a tax package that could have serious repercussions on our families’ health, well-being, and financial stability. And when we say quickly we mean QUICKLY—the House voted on their tax package last week and the U.S. Senate is voting on their plan right after Thanksgiving. They are moving at warp speed because they want to sneak this tax package (which was just also turned into an anti-health care Trumpcare bill) through Congress before the American people get a chance to speak out. Clearly we won't allow that to happen!

While the promise was to make changes that would help families like yours and mine, the current track would give over $1.5 trillion in tax cuts to millionaires, billionaires, and giant corporations. Yes, you read that right. $1.5 trillion.

A tax cut with this many zeros has to come from somewhere. Congress will basically cut essential programs like Medicaid, Medicare, SNAP, WIC, and Head Start in order to line the pockets of the already wealthy and raise our taxes at the same time. If passed, this plan will cut access to health care — and will hurt our economy. This is not ok with us. Is it ok with you?

This is why we need YOU to take action TODAY! We came up with 5 quick, easy ways for you to help stop this terrible, horrible, no good, very bad tax bill:

1. Sign Our Letter to Congress!

Sign our letter to Congress NOW and tell them to reject the tax breaks for the mega-rich and powerful, and to instead invest in programs that boost our families' health care, nutrition, and early education, as well as our economy.

2. Send a Letter to the Editor of Your Local Paper

We need to increase the visibility of this issue while U.S. Senators are home for Thankgiving and put pressure on Congress to reject this tax package! Send a high-impact Letter to the Editor to your local newspaper NOW (Members of Congress pay special attention to local press) and speak out against tax cuts for the 1% and wealthy corporations!! Don’t worry—we have a special tool that walks you through the process, gives you sample text, and sends the letter to your newspaper for you. We make is super easy for you!

3. Call Congress: 1-844-633-2048

Using MomsRising’s toll-free hotline, call your U.S. Senators and tell him/her that this tax bill is a non-starter for your family! Once you call 1-844-633-2048 we’ll give you some brief instructions and then connect you with your Senator's office.

Your experiences don’t need to be dramatic, long or well-written to be powerful and you can share your story anonymously if you prefer. There are two ways you can share your story:

- Tell us how the tax bill will affect you and your family! Do you use the medical expense deduction? Do you deduct state and local taxes? Dp you recieve your health care through the ACA exchanges? All of those things are at risk in this tax bill and we want to hear your thoughts and stories about this.

- Tell us what healthcare, nutrition, and education programs have helped your family or community and we’ll share your thoughts and experiences with our decision-makers and the public. If you have a Medicaid, Medicare, SNAP/food stamps, WIC, Head Start or childcare assistance story we want to hear from you.

Your brief thoughts can make a huge difference in the tax fight! Once you share your story with us, we’ll share it with leaders in Congress.

5. Watch and Share our Tax Explainer Video!

There is a lot of confusion (and misinformation!) about the GOP tax bill. That’s why we partnered with the amazing Erica Williams Simon to create this awesome tax explainer video so you can quickly be caught up to speed on how your family could be harmed by this tax bill….and then share it with all your friends on Facebook.

Background on Status of the Terrible, Horrible, No Good, Very Bad Tax Bill:

These tax cuts for the wealthy will raise our national deficit and hurt our economy overall. The House of Representatives passed their bill which will raise taxes on 80% of working families in order to provide tax cuts to the wealthy and powerful. In addition, it gets rid of many of the deductions that working families use to get by, including the medical deduction, mortgage loan deduction, student loan deduction, and being able to deduct state and local taxes.

The U.S. Senate is now considering a bill that is not only an awful tax bill but has also turned into an anti-healthcare bill. Senate Republicans just introduced a tax plan that would raise the taxes over the next decade for any household making $75,000 or less. To add insult to injury they are also repealing the individual mandate which would lead to 13 million people losing health care—all in order to give a $100,000 a year tax cut to the 1%. Outrageous!

Thank you for all you do! #KeepMarching!

- Elyssa, Kristin, Karen, Felicia, Donna, Khadija, Sili, Tina, Beatriz, Nadia, Nate, and the MomsRising Team

P.S. This whole Top #5Actions list is up on our blog too! Use this link to share with family and friends on Facebook, Twitter or anywhere else: https://action.momsrising.org/go/31877?t=14&akid=9968%2E847037%2EiXVwy_

Like what we're doing? Donate: We're a bootstrap, low overhead, mom run organization. Your donations make the work of MomsRising.org possible--and we deeply appreciate your support. Every little bit counts. Donate today on our secure website.

On Facebook? Become a Fan. Follow us on Twitter.

Want info from MomsRising.org in Spanish? Sign up to receive emails from our Spanish-language community, MamásConPoder.org!

What should MomsRising tackle next? Tell us what's on your mind.

Tuesday, November 14, 2017

Election Catastrophe in Virginia or We Want GOD!

|